Cost of Capital

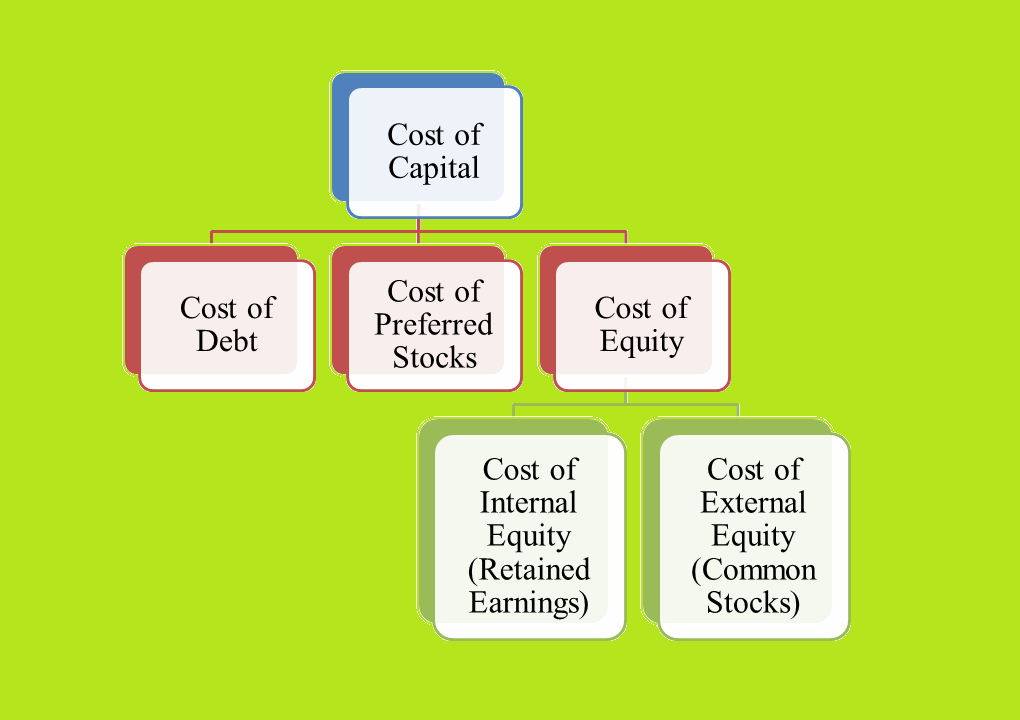

Meaning of Cost of Capital Capital is the money that is required for business day-to-day operation and future growth. There are mainly four types of shareholder's capital includes common stock, preferred stocks, debt capital (bonds and debentures) and retained earnings. Cost of capital is the weighted average cost of various sources of fund like equity and debt. It is the minimum rate of return that a company expects to earn from its investment in order to maximize the value of the firm in the market. Components of Cost of Capital Generally, there are three types of financing used by the firm include debt, preferred stock and equity. The equity further two types includes internal equity (common stock) and external equity (retained earnings). So based on these sources of fund, there are mainly four components comes for calculating cost of capital of the firm described as bellows: Cost of Debt (Kdt): It is the effective interest rate that a company is paid on its debts. It...