Valuation of Security

Meaning of Assets

Assets are the items or properties owned by person or company having value to meet various financial needs. The assets can be classified into three categories. They are

Based on Convertibility: The assets that can be whether converted into cash quickly or not. It could be current (cash and cash equivalents assets) and fixed (real) assets.

Based on Physical Existence: The assets that can be seen and having physical appearances. It could be tangible and intangible assets.

Based on Usages: The assets having various business purposes. It could be operating and non-operating assets.

As per the first category of division of assets, can be seen as in the presented table bellows:

Table: Asset Classification

Note: Financial Assets often considers as marketable securities that is one of the component of current assets.

Concept of Financial Securities

Security is a financial instrument or financial asset that can be traded i.e. bought or sold. The financial asset includes stocks, bonds, mutual funds, ETFs etc.

These financial assets has been categorized into four categories described as bellows:

Equity Securities: These securities enables person partially ownership in the company if they have bought. These securities includes company's stocks, Mutual funds (indirect way of investing in company's stocks), and ETFs.

Debt Securities: These securities are like loan that a company or government must have to re-payback. These securities includes government bonds, corporate bond, debenture, and certificate of deposits.

Hybrid Securities: These securities are the combination of both equity and debt securities having partial features of both securities. These securities includes convertible bonds, convertibles debentures, convertible preferred stocks and equity warrants

Derivative Securities: The value of these securities are derived from underlying assets or group of assets. These securities are bought or sold in terms of contract between the parties. These securities includes forward, future, swap and options.

Valuation of Financial Securities

Valuation of security is a process or technique of finding an intrinsic or theoretical value of each asset in order to explore whether they are over/under/correctly priced & trade accordingly.

The valuation of security should be calculated from the investor point of view. Basically, while finding the certain amount of security there are two things we need to calculate:

V0 = Value of 'i' security at time 't': which does come from computation or calculation

P0 = Price of 'i' security at time 't': which does come from observed from market

Bond Valuation: Bond is a long-term debt instrument issued by a corporation or government. There are different types of bonds such as treasury (government) bond, corporate bond, municipal bond, foreign bond etc. Bond valuation is the process of determining the present value or price of a bond. There following natures of bond and their formulas presented as bellows:

Table: Formula of Bond ValuationWhere,I = Interest amount

Kd = Cost of debts i.e. bond or debenture

M = Face value of bond or debenture

t = Numbers of years

n = Number of periods

V0 = Value of bond or debenture

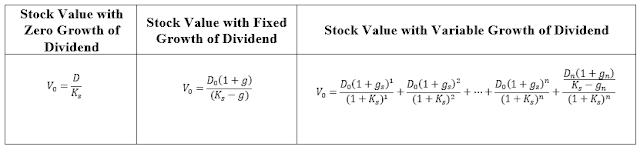

Common Stocks Valuation: Common Stock is a source of long-term financing and only corporation can issue common stock. Common stock valuation is the process of finding the present value of expected future cash flow stream. There are following methods of valuating common stock by using the formulas presented as bellows:

Table: Formula of Common Stock Valuation

Where,

D0 = Dividend per share in current year

Ks = Required rate of return of common stock

gs = Super-normal growth rate of dividend

gn = Normal growth rate of dividend

n = No. of periods in years

V0 = Value of common stock

Preferred Stock Valuation: Preferred stock is a security which lies between bond and common stock in the sense that it has claims ahead of common stock and behind bonds. Preferred stock payment treated as dividends rather than interest; they are not tax-deductible expenses for the firm. It has the characteristics of both equity and debts. Equity feature like it is a perpetual in nature while debt feature like fixed rate dividend. The following formula is to calculate the value of preferred stock as:

Table: Formula of Preferred Stock Valuation

Where,

Dps= Dividend of preferred stock

Kps = Required rate of return of preferred stock

M = Face value of preferred stock

n = Number of periods

V0 = Value of preferred stock

Decision Regarding Buy or Sell of Security

Whichever the security, the following are the general technique to take decision about buying or selling of security as:

If P0 > V0 : An overpriced undervalued - Sell it

If P0 < V0 : An under-priced overvalued - Buy it

If P0 = V0 : An equilibrium priced and valued

Note: P0 is the Price of the security while V0 is the value of the security.

Conclusion

Assets are the items or properties owned by person or company having value to meet various financial needs. The whole assets can be classified into two categories based on convertibility as fixed (real) assets and current assets or marketable securities (financial) assets. Security is a financial instrument or financial asset that can be traded i.e. bought or sold.These financial assets has been categorized into four categories include equity, debt, hybrid and derivative securities. Valuation of security is a process or technique of finding an intrinsic or theoretical value of each asset in order to explore whether they are over/under/correctly priced & trade accordingly. The valuation of security should be calculated from the investor point of view. Basically there are three securities are considered to valuation include bond, common stock and preferred stock. Bond is a long-term debt instrument issued by a corporation or government. Common Stock is a source of long-term financing and only corporation can issue common stock. Preferred stock has the characteristics of both equity and debts. Equity feature like it is a perpetual in nature while debt feature like fixed rate dividend.

Come On, Tell Me What You Think!

Did I miss something? Come on! Tell me what you think about this post on valuation of security in the comments section.

Comments

Post a Comment

If you've any doubts or suggestions please let me know.